Essar celebrates World Environment Day 2025

This World Environment Day, celebrated on June 5, 2025, Essar Oil and Gas Exploration and Production Limited, Essar Ports, and Essar Power came together in a united front to support the global theme “Ending Plastic Pollution.” Through a series of meaningful and action-oriented initiatives across locations, Essar demonstrated its deep-rooted commitment to environmental sustainability and […]

Essar’s senior leadership share their views on RBI Monetary Policy – June 2025

“Amid ongoing geopolitical tensions and softened FPI inflows, India Inc was looking for clear direction and prioritisation—and the RBI’s monetary stance has delivered just that. The 50 bps cut signals a strong push toward boosting capital investments, supporting domestic expansion, and reinforcing policy support for infrastructure, industry, and macroeconomic stability. It reflects a decisive step […]

Essar’s senior leadership share their views on RBI Monetary Policy – April 2025

As nations across the world realign economic strategies amid global uncertainties, the RBI’s rate cut and accommodative stance come as no surprise. With US tariffs heightening fears of trade wars, the global economy is undoubtedly under pressure. While India’s strong economic fundamentals and resilient domestic demand provide a buffer, the need of the hour is […]

Essar organises Dwarka Padyatri Seva Camp 2025

Jamnagar, Gujarat, March 8, 2025: Essar has organised the Dwarka Padyatri Seva Camp to support pilgrims traveling to Dwarka for the Ful-Dol Utsav on the occasion of Holi. The camp was inaugurated by Gujarat State’s Honourable Cabinet Minister, Shri Mulubhai Bera, in the presence of various government officials, the sarpanch of nearby villages, local residents, […]

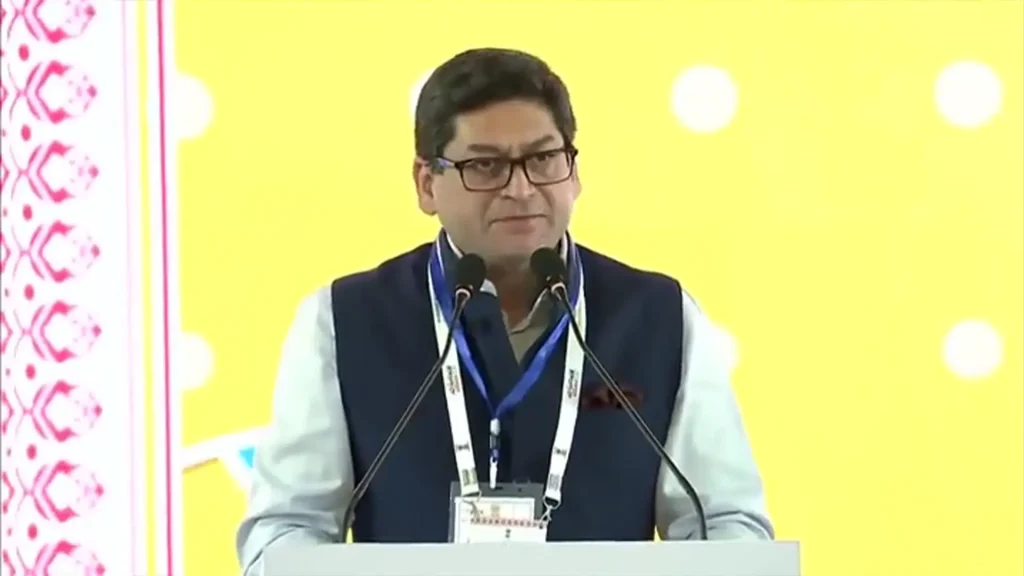

Prashant Ruia’s address at ‘Advantage Assam 2.0 — Investment and Infrastructure Summit 2025’

The vibrant city of Guwahati played host to one of the most significant events in the business and investment landscape of India—the Advantage Assam 2.0 — Investment and Infrastructure Summit 2025. Held on February 25-26, 2025, at the Veterinary Field, Khanapara, the summit was organised to spotlight Assam’s geostrategic advantages and its growing potential as […]

Essar at ET NOW Global Business Summit 2025: Driving India’s Energy Transition & Green Mobility

The 9th edition of The Times Group ET NOW Global Business Summit 2025, one of Asia’s most anticipated forums for intellectual exchange and global dialogue, was held at the Taj Palace in New Delhi on February 15th-16th. This year, the summit brought together an exceptional group of leaders, visionaries, and innovators, all focused on shaping […]

Essar at IEW 2025: A Step Forward in India’s Green Energy Transition

India Energy Week (IEW) 2025, held this year in New Delhi, once again stood out as one of the largest and most influential energy events in India, bringing together global leaders, innovators, and experts to discuss and shape the future of energy. Essar proudly participated as the Platinum Sponsor, showcasing our commitment to advancing innovative […]

Senior leadership comments on the Union Budget 2025-26

“Given the current geopolitical landscape, India needed a decisive and forward-looking fiscal roadmap to maintain its position as one of the world’s fastest-growing economies. With the fiscal deficit targeted at 4.8% of GDP for FY25 and a structured plan to reduce it in the coming years, this budget sets the foundation for sustainable growth, fostering […]

Essar Group to invest $650 mn more in US steel plant: Prashant Ruia

Company to focus on energy, metals and mining, infrastructure and technology in India, he says As President Donald Trump rolls out his Make in America plans, India’s Essar Group is finalising an additional $650 million investment in its plant in the state of Minnesota. It had invested $1.7 billion earlier. PRASHANT RUIA, director of Essar Group, […]

Prashant Ruia in conversation with Bloomberg at WEF Davos 2025

At the World Economic Forum in Davos 2025, Prashant Ruia spoke with Menaka Doshi from Bloomberg on evolving global trade amidst geopolitical shifts, and how technology will commercially enable the inevitable transition to cleaner fuels. He also highlighted Essar’s investments in building sustainable ecosystems for industrial decarbonisation, renewables, green mobility, biofuels, and digital infra. Interview […]