As India moves toward its 2030 target of hitting a 15% natural gas share in the country’s primary energy mix, commercial LNG trucking presents significant potential in a sector dominated by fleets powered by conventional fuels. It offers immediate and scalable reductions in environmental emissions while maintaining long-haul performance and payload efficiency.

GreenLine Mobility Solutions CEO Madhur Taneja spoke with Platts Editorial Lead Surabhi Sahu during the India Energy Week in Goa about the opportunities and challenges around LNG trucking. GreenLine is a sustainable logistics company and is part of the Essar Group, one of India’s largest multinational conglomerates operating across various sectors, including energy, infrastructure, metals and mining, and technology and retail. Taneja also talked about GreenLine’s expansion and diversification strategy.

What is the role of LNG trucking in the decarbonization of India’s transport sector as the nation advances its net-zero goal?

India’s road freight sector underpins industrial growth but remains predominantly diesel-based, making it one of the most difficult segments to decarbonize. LNG trucking offers an immediately deployable pathway to reduce emissions at scale while preserving long-haul performance and payload efficiency.

While LNG is not a final net-zero solution, it serves as a pragmatic transition fuel that can deliver meaningful emissions reductions today. Its role is best understood as complementary to electric and future zero-carbon technologies, helping to bridge the gap between current diesel dependence and longer-term decarbonization pathways.

What are some of the opportunities and challenges to boost LNG’s uptake in the transport sector?

The key opportunities include immediate emissions reductions, seamless integration into existing supply chains, a rising corporate focus on Scope 3 emissions, and energy diversification. Expanding LNG infrastructure along major freight corridors can significantly accelerate the adoption.

Challenges remain, including limited refueling infrastructure, higher upfront vehicle costs and the absence of targeted policy incentives. Addressing these challenges will require coordinated efforts among policymakers, infrastructure developers, OEMs (original equipment manufacturers) and fleet operators.

What can India do to overcome these hurdles that you mentioned?

India continues to face high capital costs and limited infrastructure for LNG trucks, which remain major hurdles compared with China’s experience. LNG retail outlets in India are few, and low utilization due to a small truck fleet raises break-even concerns for operators.

China’s progress was supported by large-scale station networks, demand aggregation and targeted incentives. In India, similar outcomes could be achieved through corridor-based infrastructure development, calibrated fiscal incentives, and coordinated demand commitments that reduce risk for both fleet operators and fuel suppliers.

What’s your view on the current LNG pricing economics for trucks?

LNG trucks are operating at cost parity with diesel. While upfront vehicle costs are typically 20%–30% higher, lifecycle fuel savings help offset this, resulting in comparable or slightly better total cost of ownership, especially on high-utilization, long-haul routes. Infrastructure availability and route economics remain key constraints. However, LNG is commercially viable where scale and utilization align.

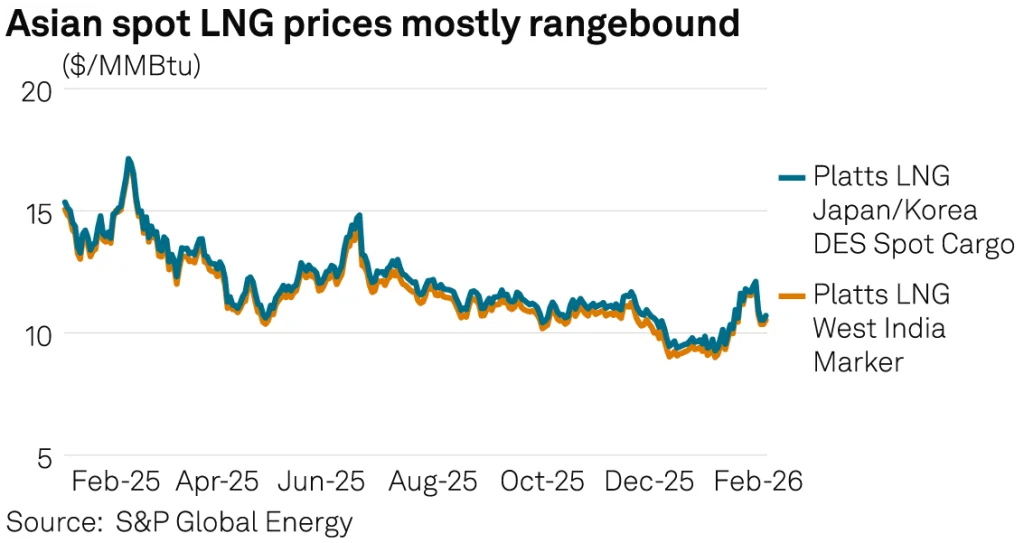

Global LNG prices may continue to experience short-term volatility, influenced by geopolitical developments, seasonal demand patterns and regional supply dynamics. However, growing supply from major exporters is expected to support gradual price stabilization over time, although periodic fluctuations are likely to persist.

Can India achieve its target of increasing the share of gas in its energy mix to 15% by 2030? How can this target be met?

Reaching a 15% share by 2030 is ambitious but achievable with accelerated infrastructure development, policy reform and demand stimulation. Expanding LNG import capacity, securing long-term supply contracts and rapidly scaling the national gas grid and city gas distribution networks will be essential.

Reforms such as competitive pricing, open pipeline access and regulatory incentives can make gas more attractive relative to coal and drive higher utilization across sectors.

Greenline Mobility Solutions has forged numerous partnerships. How can collaborations aid green mobility in India?

Our partnerships bring together industry, technology and finance to accelerate decarbonization. Collaborations with corporates enable large-scale LNG truck deployment, while partnerships with financial institutions unlock capital for fleet expansion. Technology and OEM partnerships enhance efficiency, safety and environmental performance, allowing us to scale our impact across sectors.

What is GreenLine’s fleet size and expansion plan?

GreenLine currently operates over 800 LNG trucks across major freight corridors, serving sectors including steel, cement, mining, FMCG (fast moving consumer goods) and chemicals. Operationally, our LNG trucks offer a long driving range of up to 1,200 km on a single fill and up to 2,400 km with dual tanks.

Driven by increasing corporate focus on scope 3 emissions, we are scaling our fleet in a disciplined manner. Our long-term vision is to expand our combined LNG and EV fleet to approximately 30,000 vehicles in the coming years, enabling large-scale decarbonization of freight logistics.

Has GreenLine launched EV trucks for short-haul operations, and what are the plans for growing that initiative?

Yes, GreenLine has begun deploying electric trucks for short-haul operations on high-frequency routes of up to approximately 250 km. A key milestone is our partnership with Hindustan Zinc, where we deployed 80 electric trucks for inter-unit concentrate movement between mines and smelters, supported by commercial-scale battery-swapping infrastructure.

We plan to expand this initiative by growing our EV fleet, scaling battery infrastructure, deepening customer partnerships, and deploying EVs across additional short-haul logistics corridors.

Is GreenLine expanding the LNG retail and trading business, and is the company considering venturing into new areas such as hydrogen?

Through our subsidiary, Ultra Gas & Energy Ltd (UGEL), we are expanding into LNG retail and distribution. We currently operate six LNG hubs in Bhilwara, Anand, Chakan–Pune, Jalna, Toranagallu and Vallam, each capable of servicing up to 600 trucks per month while also supplying off-grid industrial customers via a virtual pipeline model. Long-term supply agreements ensure reliability.

Our future vision includes multi-fuel hubs integrating LNG, EV charging and battery swapping for both captive and third-party users.

Green hydrogen and bio-LNG are clearly part of the long-term decarbonization roadmap for heavy transport, and we actively monitor developments in these areas. However, the current cost structures and infrastructure readiness limit near-term scalability. Our approach prioritizes solutions that can deliver measurable emissions reductions today, while remaining prepared to adopt hydrogen-based technologies when they become commercially and operationally viable.

Source: S&P Global