- December 2021 saw highest monthly volume of product sales for 18 months, since start of the pandemic

- EBITDA run rate now at annualised $300 million level

- Additional financing secured in the last quarter of 2021

- Approximately 80% of VAT deferred payments have been made in line with schedule agreed with HMRC

Stanlow, 5th January 2022: Essar Oil (UK) Limited (EOUK) today provides an update on its business, financing and VAT deferral repayments.

Customer demand hits 18-month high

A stronger trading environment saw the company record its best monthly product sales for 18 months in December 2021 across both fuels and petrochemicals, with demand now back to 95% of pre-covid levels. In addition, Essar is re-entering the Irish market having recently secured a contract to supply fuel, starting this month.

Despite the significant impact of the pandemic across the entire refining industry, including a period during which fuel demand was at very low levels, Essar continued to operate the Stanlow Manufacturing Complex at a significant capacity to ensure adequate fuel supply to its customers

across the UK. Stanlow remains a key strategic national asset, annually producing over 16% of the UK’s road transport fuels.

Company seeing stronger EBITDA

The continued strength in both demand and product margins in the market means that EOUK is now generating EBITDA at an annualised rate of approximately $300 million. This is approaching the levels seen in the five years prior to the onset of the coronavirus pandemic. Market analysts expect strong demand for refined products in the coming years on the back of a robust recovery in economic activities globally, and particularly in the UK.

Financing update

In May and September, EOUK announced that it had closed new financial arrangements with liquidity from a diversified range of sources, aggregating $1.1 billion. Additional financing has been secured during the quarter ending 31st December 2021, with last mile financing on plan to complete in the next couple of months.

HMRC arrangement in place

In September 2021, we confirmed a new TTP arrangement had been agreed with HMRC, mainly in relation to March to June 2020 VAT. This payment deferment was available to all corporates in the UK, due to the severe nature of the impact of Covid on businesses. The Company has successfully made all due payments in the three months to December 2021 and is on course to complete the balance in the quarter ending 31st March 2022.

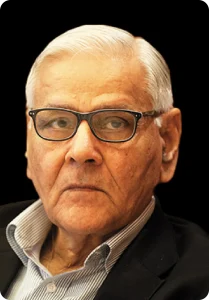

Deepak Maheshwari, Essar Chief Executive Officer, commented: “Over the last quarter, the company has been able to strengthen its financial performance due to improvements in the product market and delivery of reliable and stable operations at Stanlow. We have also closed the defined pension benefit scheme for future accruals, which will provide long-term security of competitiveness for the company. Going forward, we will invest in projects such as HyNet which will enable the country’s transition to a low carbon economy.”

Ends

About Essar in the UK

Essar Oil UK is a leading UK-focused downstream energy company whose main asset is the Stanlow Manufacturing Complex, one of the most advanced refineries in Europe situated close to the major cities of Liverpool and Manchester. Stanlow has 800 employees, and is a key strategic national asset, annually producing over 16% of the UK’s road transport fuels, while playing a key role in Britain’s broader petrochemical industry.

Since acquiring Stanlow in 2011, Essar has invested $1 billion in margin improvement and other efficiency initiatives to ensure the refinery remains competitive in a rapidly changing market.

The company is a major supplier in the North West and beyond with customers including most of the major retail brands operated by international oil companies and supermarkets, Manchester Airport, leading commercial airlines and the region’s trains and buses.

Essar is committed to playing a key role in the decarbonisation of the UK economy, with ambitious plans to build a green energy industrial cluster at Stanlow. These include the construction of two new low carbon hydrogen production units on site as part of the HyNet consortium, with a planned

total investment of approximately £750m to deliver the hydrogen production hubs. Follow on capacity growth is planned to reach 80% of the UK Government’s new target of 5GW of low carbon hydrogen for power, transport, industry and homes by 2030.

The company is also working with Fulcrum BioEnergy on a £600 million project to create a new facility to convert several hundred thousand tonnes of non-recyclable household waste each year into sustainable aviation fuel (SAF) for use by airlines operating at UK airports.

www.essar.co.uk

Media contacts:

Ian Cotton, Head of Communications

07805 854169 ian.cotton@essaroil.co.uk

Peter Ogden, Partner, Powerscourt

07793 858211 peter.ogden@powerscourt-group.com