essar global fund limited

Essar Global Fund Limited (EGFL) invests in building and nurturing assets, and creating value across core sectors.

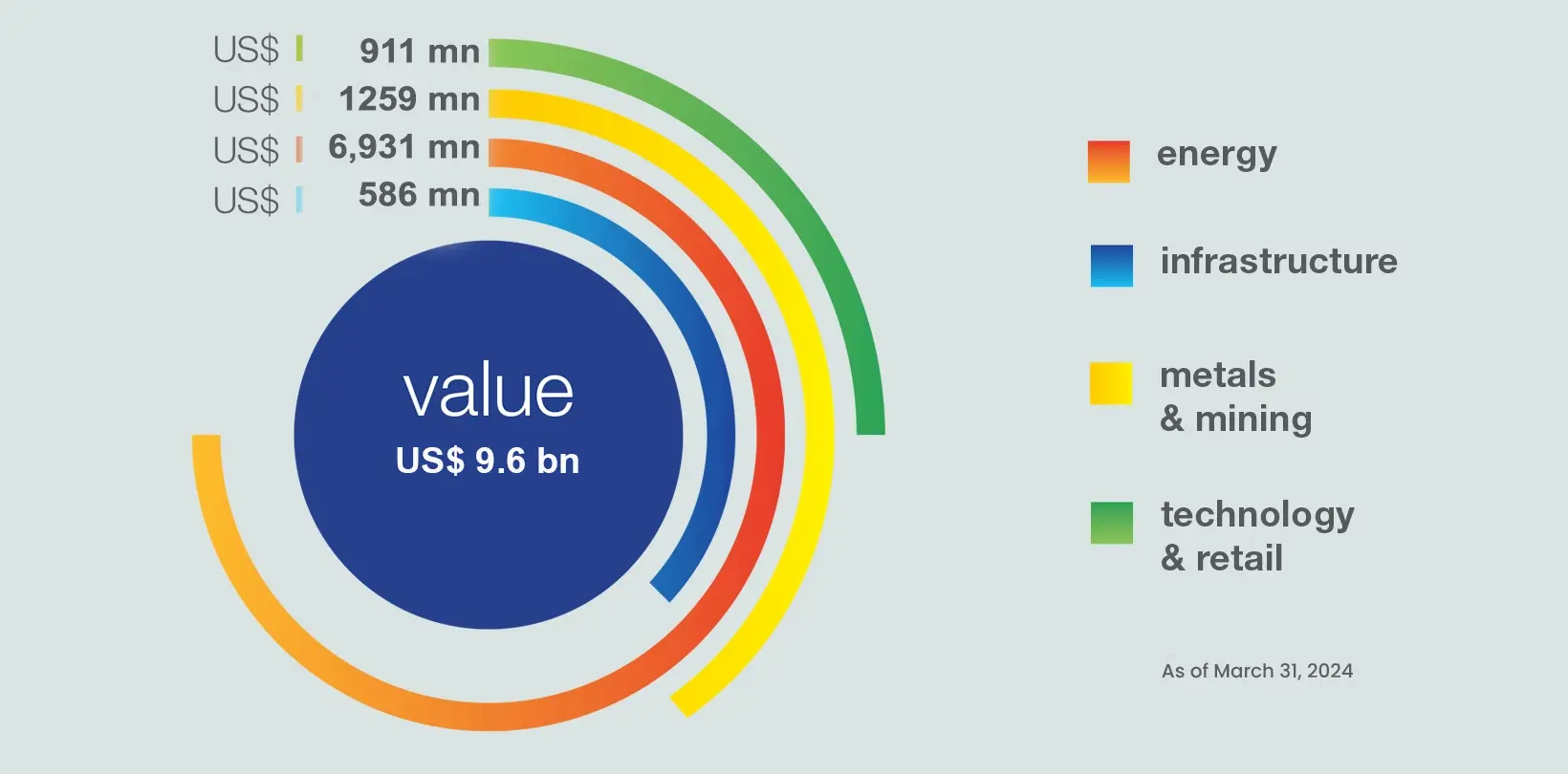

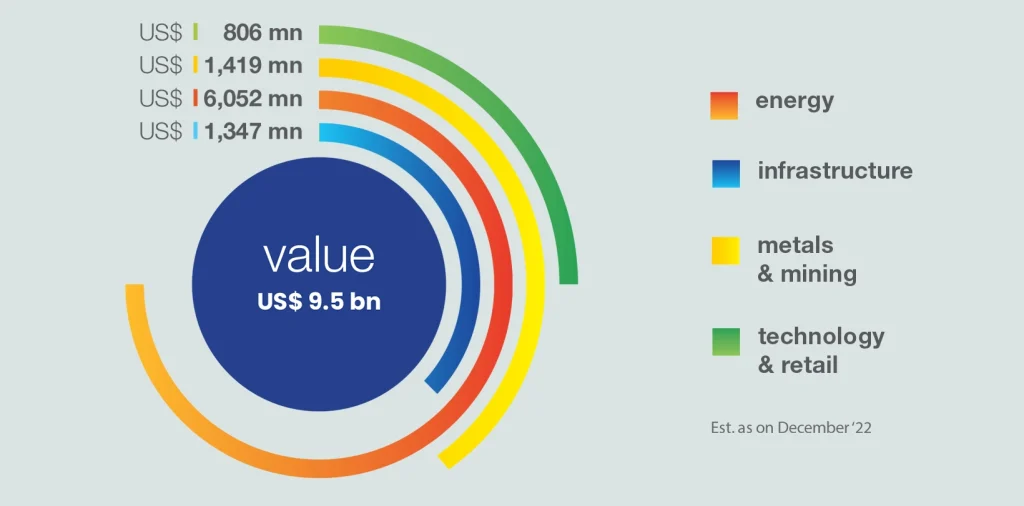

• Energy • Infrastructure • Metals & Mining • Technology & Retail

We place people before profit to arrive at superior returns, sustainably.

We follow a value-centric growth strategy which is inspired from our DNA along with a globally benchmarked robust risk and regulatory framework.

Our Assets Under Management (AUM) stood at USD 9.6 billion as on 31 March 2024.

essar capital

Essar Capital Limited is the investment manager of Essar Global Fund Limited (EGFL). It monitors and manages the entire portfolio of investments owned by EGFL. Essar Capital is governed by its board of directors.

About Exponentia Ventures

Exponentia Ventures is the venture capital arm of Essar, managing its investments in new economy opportunities, in both B2B and B2C sectors. It invests in disruptive new economy ideas that have digital agility, high-headroom, superior unit economics & the potential of global scale. Exponentia Ventures helps accelerate the growth by leveraging its deep cross-sector experience and global network to create exponential value. It collaborates with management teams to stays focused on building the growth strategy and driving its execution to ensure scale & profitability. Exponentia Venture’s current portfolio spans Green-Tech and B2C-Tech businesses.

We are committed to shaping abundant communities and thriving economies. Every day, we are strengthening assets across core sectors to create such possibilities at scale.

We are conscious of how every decision and process impacts communities and our planet. We are fast-aligning our portfolio, assets, and supply chains towards local and global net zero carbon goals. We aim to set sector-specific benchmarks with our approach to green innovations.

We run our operations in an authentic and transparent manner. We are inclusive, collaborative, and explorative in our journey towards a clean and equitable future.

We are committed to shaping abundant communities and thriving economies. Every day, we are strengthening assets across core sectors to create such possibilities at scale.

We are conscious of how every decision and process impacts communities and our planet. We are fast-aligning our portfolio, assets, and supply chains towards local and global net zero carbon goals. We aim to set sector-specific benchmarks with our approach to green innovations.

We run our operations in an authentic and transparent manner. We are inclusive, collaborative, and explorative in our journey towards a clean and equitable future.

Copyright © 2025 Essar. All rights reserved.

Dr. Sanjeev Gemawat currently serves as the Managing Director & Group General Counsel at Essar Group. Prior to joining Essar, Dr. Gemawat held leadership positions with prestigious corporates like Vedanta, Dalmia Bharat, DLF and JCB, where he played a leadership role in overseeing complex legal and regulatory frameworks both India and multiple global jurisdictions.

With nearly three decades of legal experience spanning a wide array of industries like mining & metals, energy, infrastructure, real estate, natural resources, manufacturing and technology; Dr. Gemawat is widely respected in the fields of litigation and arbitration, M&A, corporate governance, compliance and risk management.

He has been honoured as Top General Counsels of India in various prestigious General Counsel lists as released by Forbes India, Business World etc. He has been honoured as one of “India’s finest in-house counsels”, the “Most Influential Corporate Counsel And Company Secretary” and also inducted to “Global Hall of Fame” for his contribution in the Legal Eco System in India and the World.

Besides being a postgraduate in Law and Doctorate in Insider Trading, Dr. Gemawat is a Chartered Accountant, Cost & Management Accountant and Chartered Secretary from India and the UK.

Artem Matyushok currently serves as Senior Managing Director – Strategy and Business Development at Essar Capital. Artem has served as senior executive with major natural resource companies and has 20+ years of experience in the Energy & Natural Resources sector, ranging from the start-up operational environment to the corporate division of a major FTSE 100 company. Artem has done his Masters in Finance from Northern Kentucky University, holds PhD in Economics, is CIMA (UK) qualified as well as a former Shell alumni. While working at Shell he obtained project management and execution skills as well as strong standards in corporate governance. During his commercial carrier he executed over $100bn worth of high profile M&A transactions. He continues to advise companies’ Boards on Decarbonisation initiatives, Energy Transition and brings in-depth knowledge of the Hydrogen economy and its application, particularly in Metals & Mining sector.

Rakesh Kankanala is the Managing Director, Metals and Mining of Essar Capital. An MBA from IIM Lucknow, Rakesh is a qualified Engineer from NIT, and brings with him 13 years of experience. Prior to being the Managing Director at Essar Capital, Rakesh has been at leadership positions in Essar Ports. Earlier on he has worked with TCS in the beginning of his career.

Rajiv Agarwal is the Managing Director & CEO at Essar Ports. He has over 30 years of experience and has held leadership positions in sectors such as Ports, Shipping, Telecom, Retail and Business Processing Outsourcing. He was appointed as MD & CEO of Essar Shipping, Ports & Logistics Limited in 2010.He Joined Essar in 1997 as COO in Essar Telecom and was the Executive Director of Essar Shipping Limited from 1998-2002.

He has been a key member of several industry committees like Confederation of Indian Industries, Federation of Indian Commerce Industries, The Associated Chamber of Commerce & Industry of India and SUPERBRANDS for several years.

Prashant Ruia is a second-generation entrepreneur who belongs to the founding family of Essar Group. Having been inducted into the business at an early age Prashant at 55 is an industry veteran. He has been at the helm of decision making for the Essar Group for more than four decades.

Essar Group is one of India’s largest multinational conglomerates, operating across Energy, Infrastructure, Metals & Mining and Technology & Retail sectors. Essar with an asset base of $9.6 billion, and annual revenues of $15 billion is fast-aligning to the needs of a low-carbon economy and global Net Zero carbon goals by investing in technology and innovation in each of the four sectors where it is present.

Prashant is an active member of the UK India Business Council (UKIBC), Young Presidents Organization (YPO), Confederation of Indian Industries (CII), Entrepreneurs Organization (EO) and a board member in the US-India Strategic Partnership Forum (USISPF).

Shashi Ruia, a first-generation entrepreneur industrialist, has made invaluable contributions to the core industrial and infrastructure sectors in India and has steered Essar to a prominent position in the global industry.

Mr Ruia began his career in the family business in 1965 under the guidance of his father, the late Nand Kishore Ruia. Along with brother Ravi, Shashi Ruia laid the foundation of Essar and spearheaded its business strategy, diversification and growth. Today, Essar Global Fund Limited (EGFL), which owns the businesses the brothers co-founded, is a global investor, owning a number of world-class assets diversified across the core sectors of Energy, Metals & Mining, Infrastructure, Technology and Services. The Fund’s portfolio companies generate aggregate revenues of US $14 billion. These companies operate more than 50 assets spread across the globe, while adhering to international standards of health, safety, environmental protection and corporate governance.

Essar has time and again demonstrated its ability to build and operate world-class assets that have elicited the interest of the best global players. Essar’s portfolio businesses in the Telecom, BPO and Oil & Gas sectors have attracted more than US $40 billion of monetisation proceeds from global majors, like Vodafone, Rosneft, Trafigura and Brookfield.

Shashi Ruia’s vision saw Essar gain a first-mover advantage in many businesses. For example, when the Indian telecom sector was opened up for private participation, Essar was among the first companies to offer mobile telephony services.

Mr Ruia is on several important national bodies and industry associations. He was on the managing committee of the Federation of Indian Chambers of Commerce and Industry (FICCI), an apex body of India’s trade and business associations. He has also been the Chairman of the prestigious Indo-US Joint Business Council and is a former president of the Indian National Shipowners Association (lNSA). Mr Ruia is a member of the PM’s Indo-US CEO’s Forum and India – Japan Business Council

In 2007, Mr Ruia joined an elite list of achievers, which includes the likes of Richard Branson, Peter Gabriel, Ray Chambers, Pam Omidyar, Amy Robbins and Richard Tarlow, who independently fund The Elders. The Elders is a group of world renowned personalities, comprising Desmond Tutu, Graça Machel, Kofi Annan, Jimmy Carter, Li Zhaoxing, Mary Robinson and Muhammad Yunus, who have joined hands to tackle the world’s most difficult problems.

Mr Ruia was also the recipient of the Business India Businessman of the Year Award 2010.

Widely regarded as one of the architects of modem India, Shashi Ruia has a passion for education and mentoring young talent. He is proud of all the employees of Essar who have done well for themselves under his stewardship.

Ravi Ruia belongs to the generation of industrialists who have played a significant role in leading India’s industrial renaissance. An engineer by training, his entrepreneurial abilities have enabled the Essar Global portfolio of companies to become one of the leading names in global industry.

Ravi began his career in the family business and has worked with his elder brother, Shashi Ruia, toward steering the company to its current position of eminence, helping in the consolidation of its businesses and through setting up overseas ventures.

The two brothers, Shashi and Ravi, jointly founded Essar Global Fund Limited (EGFL) as a diversified global private fund exclusively managed by its investment manager, Essar Capital Limited. EGFL is a global investor, controlling a number of world-class assets diversified across the core sectors of Energy (comprising Exploration & Production, Refining & Marketing and Power businesses), Infrastructure (comprising Ports, Terminals and EPC businesses), Metals & Minerals, and Services & Technology (comprising Shipping, Oilfield services and Technology Solutions).

EGFL invests long-term capital into the portfolio companies and holds near 100% stake in all its investments. EGFL invests with a sense of active ownership, which involves direct engagement with the management of the respective businesses. The portfolio companies have aggregate revenues of about USD 13 billion and employ over 7,000 people.

Essar has time and again demonstrated its ability to build and operate world-class assets that have elicited the interest of the best global players. Essar’s portfolio businesses in the Telecom, BPO and Oil & Gas sectors have attracted more than $30 billion of monetization proceeds from global majors, like Vodafone, Rosneft and Trafigura.

Ravi has overseen Essar’s globalization plans, including new ventures in the United States, Africa, South East Asia and the Middle East, and has led several investments and divestments for Essar globally. Ravi was a recipient of the Business India Businessman of the Year Award 2010.

Alok Gupta is the Operating Partner, Technology & Retail, at Essar Capital. With over 32 years of work experience in the technological sector, Alok leads all new capital investment recommendations to the company’s board.He joined Essar as CEO Retail in the year 2010. Subsequently he took responsibility as President – Global Markets & Strategy since 2012 where he was responsible for sales, pricing strategy, marketing, and product & category management for the Steel business.Prior to joining Essar, he has worked with Café Coffee Day and UB Spirits.

Mr Naushad Ansari is Managing Director, Business Development, at Essar Capital. He would be responsible for advising and leading the company with regards all investments and opportunities in the metals & mining sector.

He is an experienced professional and an industry veteran, with 33 years’ experience with Tata Steel and 11 years with Jindal Steel & Power. He is a strong business development professional with a Mechanical Engineering Degree from Aligarh Muslim University.

Madhu Vuppuluri is the Operating Partner, Metals & Mining, Essar Capital. With over 27 years of work experience in diverse industries ranging from Manufacturing (Metals, Mining & Power Generation) to Services sectors (Commercial Airline and Technology, inclusive of Business Process Outsourcing sectors), he provides strategic direction to the management of the Mesabi Portfolio. Madhu’s expertise lies in the area of mergers & acquisition, fund raising, investor relations, and operations management, and leads future capital investment recommendations to Essar Capital’s Board of Directors.

Jatinder Mehra is the Vice Chairman & Operating Partner of Essar Capital. With more than 50 years of experience, he guides Essar through transformations, manages operating functions and leads complex projects.Mr Mehra is involved in various Essar initiatives in areas of Business Strategy, Investments, Corporate Governance, Risk Management and Sustainability.Prior to joining Essar Capital, he lead several reputed public sector and private steel companies, including Steel Authority of India Limited and Rashtriya Ispat Nigam Limited as their Chairman and Managing Director.

Rahul Taneja is the Managing Director, Human Capital at Essar Capital. He is responsible for all HR matters for the Metals & Mining and Services & Technology portfolios.

Rahul is a seasoned professional with more than 28 years of experience specialising in areas of recasting HR and business processes, right sizing and cost optimisation. He also has rich experience in leading change management, cultural transformation, organisational redesign and restructuring. He has held key leadership positions at Jindal Steel & Power Ltd, Jet Airways, Essar and Dell international.

Andrew Wright is the Managing Director, Legal, at Essar Capital. He is responsible to advise and represent the company for all the legal matters concerning the Energy sector investments and portfolio businesses.

Having completed his law degree from the University of Leeds, United Kingdom, Andrew has over 25 years of rich experience.

Mr Viral Gathani is the Managing Director, Finance, Energy, at Essar Capital. He is a seasoned professional with over 27 years of experience, including 23 years in international investment banking & private equity. He has led natural resources sector businesses for major investment banks globally. He has also advised boards and management on major transactions in 34 countries.Viral has held key leadership positions at Vedanta Resources Plc, CIMB Securities/ Royal Bank of Scotland, Warburg Pincus, Citigroup, and Credit Suisse.

Sunil Jain is the Operating Partner for Energy transitions. He brings with him 39 years of experience, and has extensive experience in the renewable energy sector.Prior to Essar, he was the CEO & Executive Director of Hero Future Energies Pvt Ltd. He started his career with Escorts Limited where he worked and grew through various roles of operations and business development. Sunil is also the President of Wind Independent Power Producers Association.In 2012, he was awarded an excellence award for his contribution to renewable energy and sustainability by the Energy and Environment Foundation. His academic research paper on “Sustainability and Renewable Consumption Obligation” has been presented at forums of international repute.

B.C. Tripathi is the Vice Chairman, Exploration & Production at Essar Capital, and has over 36 years of experience across Operation & Maintenance of Pipelines, Project Management, Contracts Management, Customer Relationship Management, Marketing etc. He is the former Chairman and Managing Director of state-run natural gas giant GAIL India Ltd and had started his career in Oil and Natural Gas Corporation.

Kailash Daultani currently serves as the Managing Director, Treasury and Finance, at Essar Capital. With 18 years of experience, he has also served as the Senior Vice President, International Projects and Corporate Finance, with Essar Services. A qualified chartered accountant, Kailash joined Essar in 2003 after working with Chaturvedi & Shah and Dewani & Co.

Adithya Bhat, with over 27 years of experience in Governance, Risk and Compliance (GRC), is the Chief Risk Officer at Essar Capital. He is responsible for investigation, analysis and assessment of risk, and accordingly design and implement strategies and processes which mitigate these threats. He also ensures the successful delivery of the organisation’s corporate and business plans and desired outcomes.

Prior to this, he was a partner with KPMG’s risk consulting practice focusing on enterprise and compliance risk management, partnering with leading multinational companies in areas of GRC in India, North America and Middle East.

He has also led digitalisation initiative in GRC space and was instrumental in running technology-based solution around enterprise risk, compliance risk, license management and document repository systems. In addition, in an honorary capacity, Adithya is currently the Senior Vice President at the India Chapter of Institute of Internal Auditors Inc, USA and President elect for 2021 – 22.

Priya Chakravarty is the Senior Director, HR, at Essar Capital. She has more than 23 years of experience in Human Resources, having worked across industries like Manufacturing, Pharma, IT and Retail. In her last assignment as Chief People Officer – Hometown & Ezone, Priya was responsible for driving a transformational HR agenda that focused on organisational culture, building a talent pipeline, and initiating & aligning all people practices to business achievement. She has earlier worked with Cipla as Head HR – International Business and has also volunteered with the Akanksha Foundation. In her earlier stint with Essar, Priya has worked at Senior Management roles, initially with Essar Oil and then as Head – International HR (Corporate HR).

Dhanpat Nahata is the General Partner, Strategy and Risk, at Essar Capital. With over 20 years of experience in the field of M&A and transactions, he leads all the M&A structuring on complex transactions globally for Essar Capital. He is a part of the Management Committee of Essar Capital.

Prior to joining Essar, he was associated with EY as a Partner for 11 years.

Haseeb Drabu is an economist with over 30 years of experience with diverse skill-sets and wide-ranging experience as a lawmaker, policy planner, banker and an economic commentator.

He has worked as an Economic Advisor, and the principal economic policy maker at the state level for seven years. He was chairman and chief executive of J&K Bank for five years. In his avatar as editor of a business daily, he also made his mark as a widely respected and incisive columnist on macroeconomics, fiscal and monetary policy.

Srinivasan Vaidyanathan is the Operating Partner, Technology & Retail, at Essar Capital. With over 30 years of experience in operational leadership, investment management and business growth across diverse sectors, Srinivasan provides a critical evaluation of current and future capital investments.

His strength lies in leading new business development opportunities and conducting preliminary due diligence and analysis of emergent companies and partners.

Prior to Essar, he has worked with Archean Group as Group President, and with SIVA group as CEO for about 15 years.

No content available

Anshuman Ruia is part of the second generation of the Ruia family that founded Essar. Essar was founded in 1969 by his father, Shashi Ruia, and uncle Ravi Ruia.

Mr Anshuman Ruia is known for his financial expertise and project execution skills. He has overseen Essar’s BPO and Power businesses, and was instrumental in creating Aegis, the BPO arm of Essar. The Aegis business was monetised at a value almost 20 times the investments made. He is also responsible for the expansion and diversification of the Power business into new, renewable energy sources and its entry into the transmission and distribution segment.

Mr Ruia is a member of the YPO (Young Presidents Organisation), a connoisseur of music and a keen table tennis player.

With a mission to promote awareness about menstrual hygiene, the Sahej mobile app was launched to provide knowledge & access to affordable menstrual products to women from all social classes. Click here to download the app.

Over 4,00,000 sanitary napkins distributed to women in Mumbai slums & Mumbai police.

With a mission to promote awareness about menstrual hygiene, the Sahej mobile app was launched to provide knowledge & access to affordable menstrual products to women from all social classes. Click here to download the app.

Over 4,00,000 sanitary napkins distributed to women in Mumbai slums & Mumbai police.

No content available

No content available

No content available

No content available

No content available

3Ply masks, N95 masks, Personal Protective Equipment (PPE), protective gloves, hand sanitisers and hand soaps supplied to hospitals, police stations, CISF and village communities

Installed a Walk-in Sample Kiosk (WISK) Chennai hospital

Meals/ dry ration/ vegetable kits provided to slum dwellers, migrant labourers, marginalised families, ragpickers, orphanages, transgenders and families in remote villages/ Adivasi tribes.

Ready to Eat (RTE) meals served to frontline warriors, i.e. doctors, police, etc

Smiti is a self-driven business leader and a true entrepreneur at heart. With over 15 years of experience in diverse fields including media & publishing, corporate communications, and mergers & acquisitions, Smiti Kanodia has been a guiding force behind the evolution of corporate brand communications and human resource management at Essar.

In her current capacity at Essar, she is actively involved with the Group’s Corporate Social Responsibility initiatives through Essar Foundation. Her keen interest in sustainable business practices and corporate citizenship has manifested in connecting with CSR evangelists and bringing global best practices to the organizations she supports.

In the past, at just 24 years, Smiti founded a publishing company, Paprika Media, which published the internationally acclaimed entertainment and lifestyle magazine, Time Out. The magazine, which had a readership of 6 lakhs, published editions from three cities in India—Mumbai, Delhi and Bangalore—and created well-known media properties, like the Time Out Food Awards.

Smiti’s ability to provide a unique perspective on brand strategy through the combination of creative thinking comes from her education in both finance and publishing. She received her bachelor’s degree in Finance & Marketing from New York University’s Stern School of Business and a postgraduate degree in Publishing from the London College of Printing. Early in her professional career, she worked as a Mergers & Acquisitions analyst in the telecommunications sector at Lehman Brothers in New York.

A member of the founding family of Essar, Smiti is the daughter of Madhu and Ravi Ruia, who is co-founder of Essar. She is married to Nishant Kanodia, Vice Chairman of the Matix Group, Smiti and Nishant have two children.

Vikash Saraf is the non-executive director of Essar Capital. He has over 25 years of work experience in the field of M&A and Transactions.

He joined Essar in early 2000 and has played a key role on strategic investments of Essar in core economy and infrastructure sectors. Vikash is also a member of the Management Committee of Essar Capital.

Prior to joining Essar Capital, Vikash was an Executive Director and CEO of SSKI Corporate Finance Ltd, a boutique investment bank specialising in infrastructure financing and advisory.

No content available

No content available

No content available

No content available

No content available